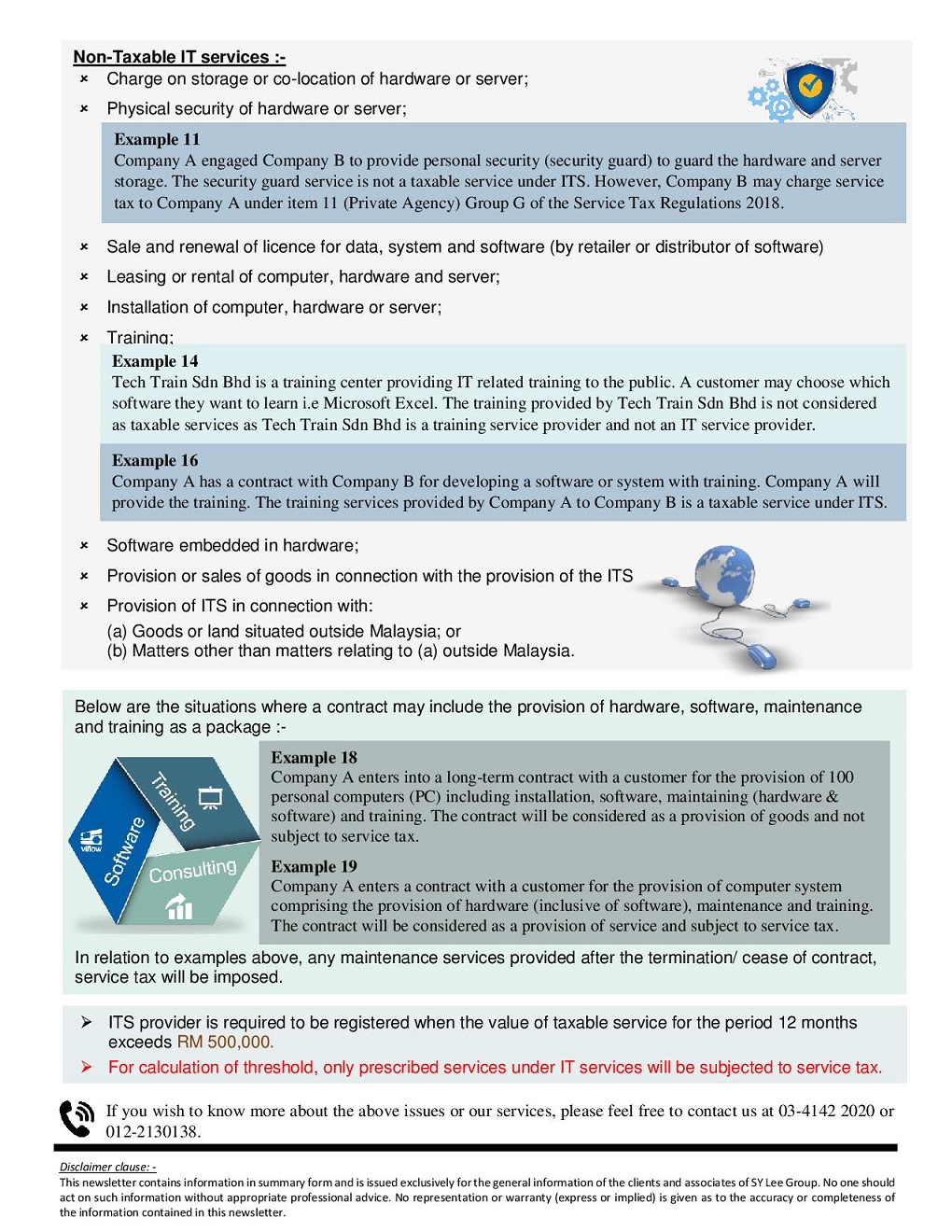

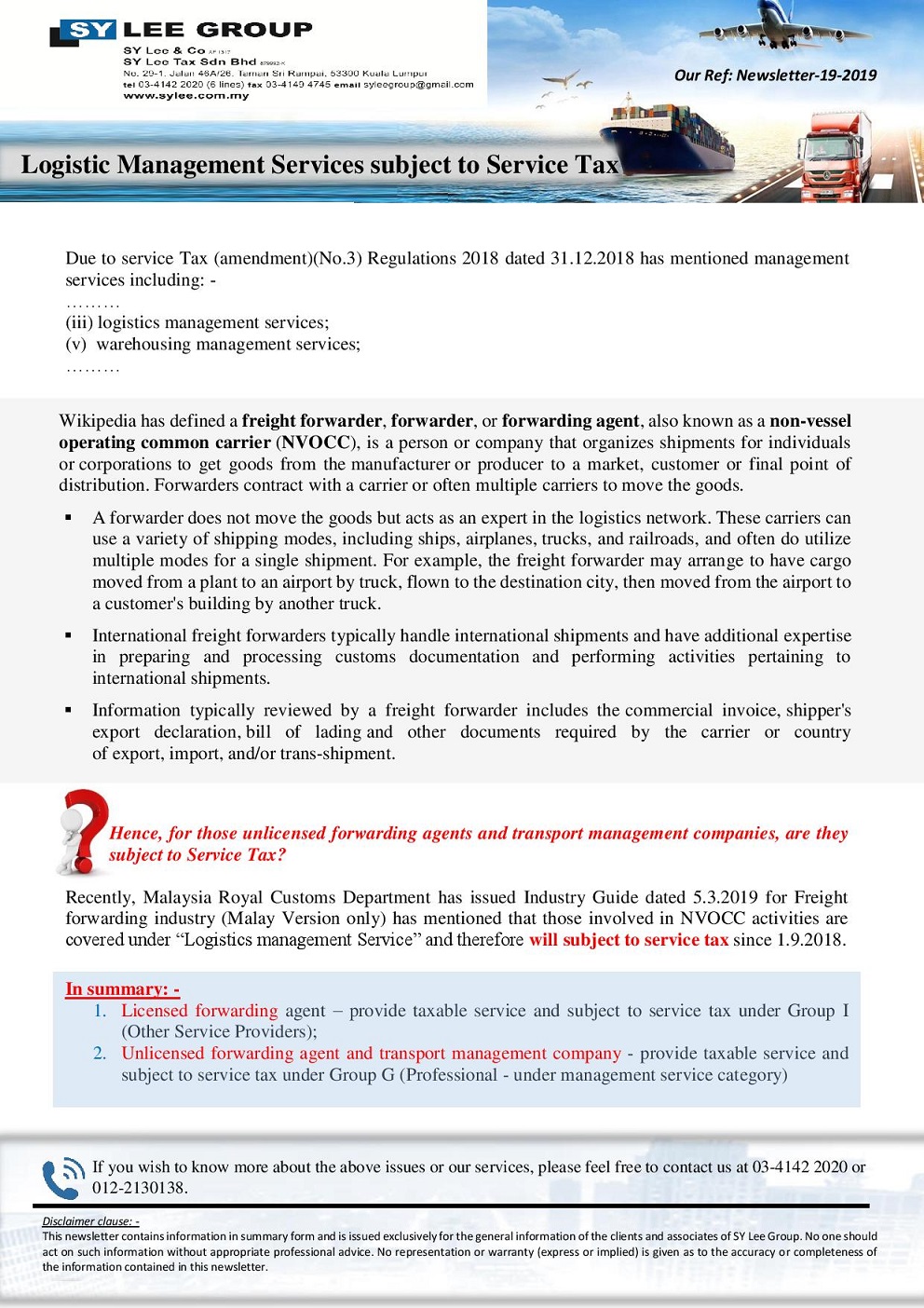

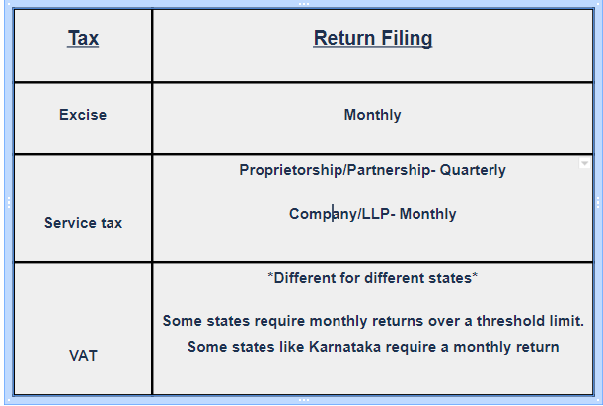

Service Tax Regulations 2018 Group G

A complete list of taxable persons and taxable services can be found in the first schedule to the service tax regulations 2018.

Service tax regulations 2018 group g. 1 taxable person item 12 any person who operates online platform or market place. Group category service provider g professional services threshold. Amendment 1 2020 service tax digital services regulations 2019. However the taxable services within the same group will still need to be combined as a total value of taxable services under the group and if exceeds the threshold for registration within a 12 months period the person will be liable to register under the service tax 2018.

Service tax regulations 2018. Regulations 2018 ii service tax persons exempted from payment of tax order 2018 b2b exemption 1 exemption of service tax on b2b services a taxable person specified in column 1 of group g who provides taxable service as specified in column 2 of group g in the first schedule of the service tax regulation 2018 is exempted from paying. Licensed or registered surveyor. Intra group reliefintra group relief is applicable on the acquisition of imported taxable services under group g professional services first schedule of service tax regulations 2018 except for employment services and private agency if a company acquires the mentioned taxable services from a company within the same group of companies outside of malaysia such acquisition of service would.

Amendment 1 2020 service tax compounding of offences regulations 2018.

(no%203)%20regulations%202018-page-002.jpg)