Real Property Gain Tax Act 2017

This article is relevant to candidates preparing for p6 mys and the laws referred to are those in force at 31 march 2017.

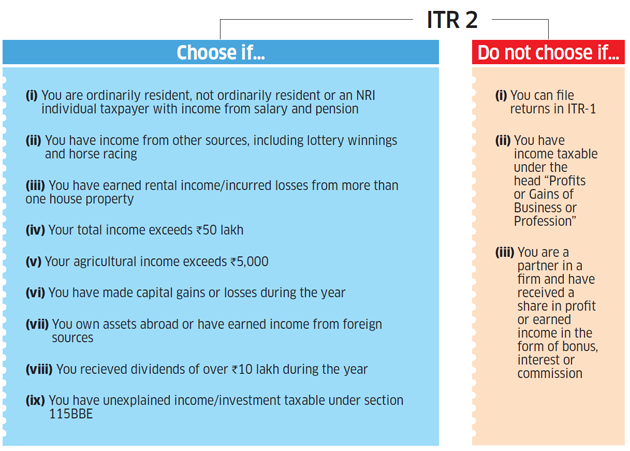

Real property gain tax act 2017. On december 20 2017 president trump signed the tax cuts and jobs act of 2017 tax act ushering in an extensive array of new tax laws. An act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto in its simplest form it s basically a tax charged on the capital gain or net profit a seller makes when he or she sells a property. 1 in this act unless the context otherwise requires accountant means an accountant as defined in subsection 153 3 of the income tax act 1967 act 53. A chargeable gain is a profit when the disposal price is more than the purchase price of the property.

Based on the real property gains tax act 1976 rpgt is a tax on chargeable gains derived from the disposal of property. Max capped at rm10k. 10 of profits or rm10 000 per transaction whichever is lower is not taxable. The finance no 2 act 2017 fa received royal assent on 27 december 2017 and was introduced to amend the income tax act 1967 the real property gains tax act 1976 rpgta the goods and services tax act 2014 and the finance act 2013.

Real property gains tax exemption order 2011 5 2 2 where the disposal of a chargeable asset is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter the minister exempts any person from the application of schedule 5 of the act on the payment of tax on the. This article discusses the provisions in the income tax act 1967 the act and the real property gains tax act 1976 rpgt act. This amount of tax may consist of capital gains tax payable by an individual or the alternative minimum tax. Readers should not act on the basis of this publication without seeking professional advice.

Let s check out the real property gain tax exemption here. This article will discuss the amendments to the rpgta as provided in sections 16 17 and 18 of the fa. While reading this article candidates are expected to make concurrent references to the relevant provisions of the act and the rpgt act as. Primary residence homeowners mortgage interest deduction.

Firpta imposes taxes on foreign corporations for sales of u s. Real property is defined as. Real property interests according to 882 a 1 of the irc which may include the regular corporate tax rate the alternative minimum tax or the alternative tax for corporate capital gains. This is great as we all can be benefit from this exemption.

Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc. Among them were some fundamental changes that affect primary residence homeowners as well as owners of investment real estate.