Income Tax Relief 2019

Because this is the most comprehensive and practical guide on income tax relief in malaysia for the non tax savvy you yes you.

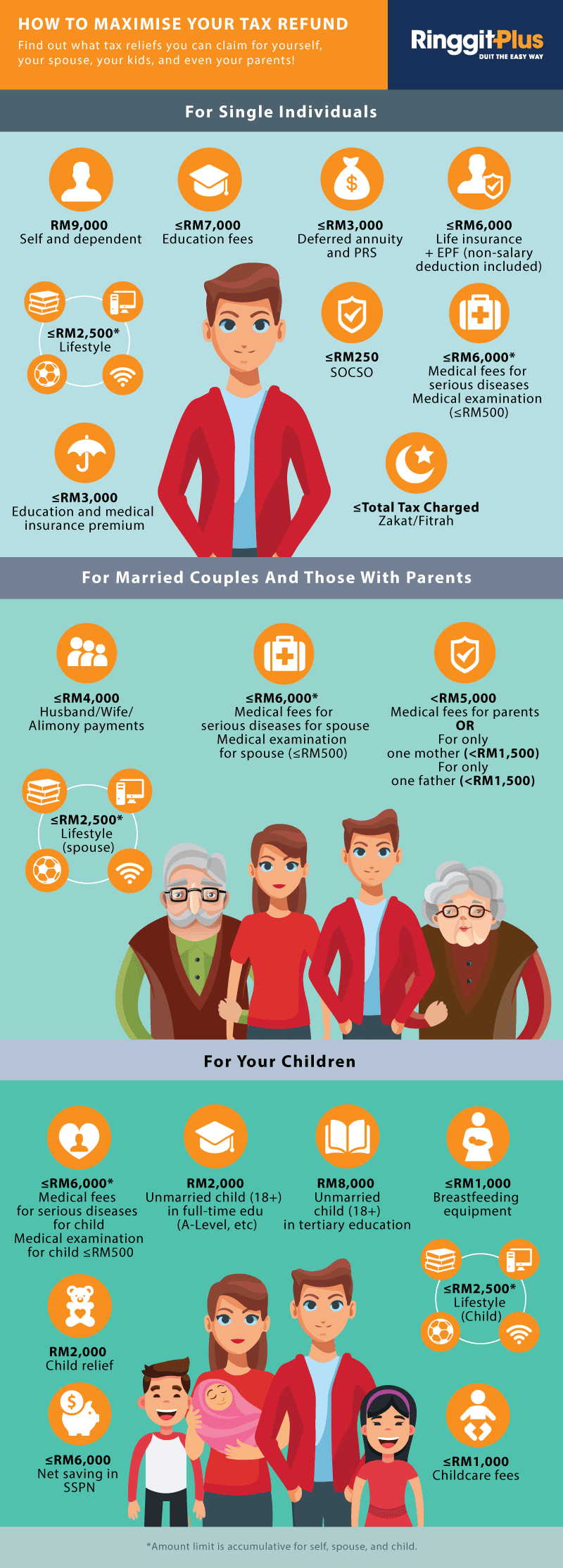

Income tax relief 2019. She paid no tax because her income is under the tax free threshold. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Amount rm 1. Personal income tax relief cap of 80 000.

There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. Example income up to 37 000. An individual is regarded as tax. The cap on personal income tax relief applies to the total amount of all tax reliefs claimed which is effective from ya 2018.

There are currently 15 personal income tax reliefs and each relief serves a worthy objective. Why is the 80 000 personal income tax relief cap introduced. Jacqueline s taxable income is 18 000. Then you have landed in the right page.

Previously the relief was limited to rm1 000 in ya 2019. Personal income tax tax residence status of individuals. For example if you are 55 years old as at 31 dec 2019 and have taxable earned income of 5 000 in 2019 you will get earned income relief of 5 000 instead of 6 000 for the year of assessment. Medical expenses for parents.

This measure will reduce income tax for 30 6 million income tax payers in 2019 to 2020 30 7 million in 2020 to 2021 including low and middle income individuals improving incentives to enter. Standard rate marginal relief all income liable to jersey tax less allowable expenses and pension contributions charged at 20 a ll income liable to jersey tax less allowable expenses pension contributions and your tax exemption charged at 26 you will pay tax at the lower of the two calculations which means that your tax rate depending on your income will be between 0 and 20 max. A new policy that took effect from ya 2018 is the personal income tax relief cap which limits the total amount of personal reliefs an individual can claim to 80 000 per ya. Individual s chargeable income does not exceed rm35 000.

Tax rebates for resident individuals. New in year of assessment 2018. If the amount of taxable earned income is lower than the maximum amount claimable the relief will be capped at the amount of taxable earned income. This relief is applicable for year assessment 2013 and 2015 only.

Under the penjana recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from rm2 000 to rm3 000 however this is not applicable when you file this year as it only applies to the year of assessment.

.jpg)

.jpg)